Apartment Loans | Multifamily Loans

| Apartment Loan Rates Over $6,000,000 | Rates (start as low as) | LTV | |

|---|---|---|---|

| 5 Year Fixed Rates | Up to 80% | Get Free Quote | |

| 7 Year Fixed Rates | Up to 80% | Get Free Quote | |

| 10 Year Fixed Loan | Up to 80% | Get Free Quote | |

| Apartment Loan Rates Under $6,000,000 | Rates (start as low as) | LTV | |

| 5 Year Fixed Rates | Up to 80% | Get Free Quote | |

| Year Fixed Rates | Up to 80% | Get Free Quote | |

| 10 Year Fixed Rates | Up to 80% | Get Free Quote |

Our Apartment Loan Benefits

Apartment Loan rates start as low as (as of February 5th, 2026)

• A commercial mortgage broker with over 30 years of lending experience

• No upfront application or processing fees

• Simplified application process

• Financing up to 80% LTV

• Terms and amortizations up to 30 years

• Long term fixed rates

• Loans for purchase and refinance, including cash-out

• 24 hour written pre-approvals with no cost and no obligation

Recent TRUSTPILOT Reviews

Select Commercial Funding Reviews from TRUSTPILOT

A three year journey

"Thanks Stephen for all of your hard work in getting our deal closed! I appreciate your professionalism and patience throughout a complicated process. You always were there for my partner and I whenever we had questions and needed answers quick. It was a pleasure to have worked with you and Select Commercial!"

Apartment Loans

We are experts in securing apartment loans and mixed use mortgages. Sometimes referred to as multifamily loans, these types of loans have traditionally constituted the largest portion of our total business volume. We have information that can help you with How to Buy an Apartment Building. Mixed use mortgages are used for buildings that offer multifamily units along with a business usually located on the first floor. Whether you are looking to finance a small apartment building, a complex with hundreds of units, or a co-operative looking for an underlying mortgage, we can help you find the optimal financing solution to meet your apartment loan needs. Our company has access to multiple capital sources, including: Fannie Mae, Freddie Mac, HUD, numerous local and national banks, Wall Street conduit lenders, Agency lenders, credit unions and insurance companies. We will entertain multifamily loan requests of all sizes, beginning at $1,000,000. See our article published in a major magazine on How to Invest in an Apartment Building and how to get the best rate on a apartment loan. We arrange financing for the following:

- Large urban high-rise apartment buildings

- Owner occupied multifamily financing

- Suburban garden apartment complexes

- Small apartment buildings containing 5+ units

- Underlying cooperative apartment building loans

- Portfolios of small apartment properties and/or single-family rental properties

- Other multi-family and mixed-use properties

Our company has multiple capital sources and multifamily lenders for these commercial multifamily loans, including: Fannie Mae, Freddie Mac, FHA, national banks, regional and local banks, insurance companies, Wall Street conduit lenders, credit unions and private lenders. Whether you are purchasing or refinancing, we have the right solutions available. We will entertain loan requests of all sizes, beginning at $1,000,000. Get started with a Free Loan Quote.

Apartment Loan Products

Freddie Mac Multifamily Loan

Fannie Mae Multifamily Loan

FHA HUD Multifamily Loans

Underlying Co-op Loans

Apartment Bridge Loan

CMBS Loan

Apartment Loan Helpful Articles

How to Get the Best Rate on a Multifamily LoanFannie Mae and Freddie Mac 2022 Update

How To Get The Best multifamily mortgage Rates On An Apartment Refinance

What Do Underwriters Look for When Evaluating Apartment Loans?

What You Need to Know About Freddie Mac SBL Multifamily Loans

How to Calculate Debt Service Coverage Ratio for Apartment Loans

Apartment Occupancy Levels – Concern in Some Major US Markets

How to Invest in an Apartment Building

Are You Shopping for an Apartment Building Loan?

How to Buy an Apartment Building

What Are Commercial Mortgage Lenders Looking for These Days

Uncomplicated Underwriting

How to Qualify for a Great Rate When Refinancing Your Apartment Building

Recent Closings

Apartment Loan Outlook 2022

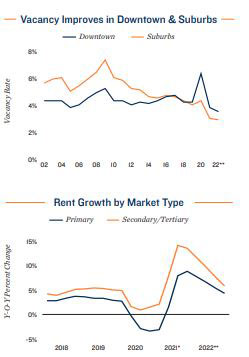

Apartments Show Record Strength as Household Growth Performs at Record Levels In 2022 we expect strong housing demand to surpass existing supply. 2021 was a very strong year for apartment owners. After the difficulties of 2020 due to the pandemic caused much disruption, rapid job creation and a strong economic reopening led to a surge in apartment rentals. A record number of units were rented in 2021, driving the national apartment vacancy rate down to the lowest year-end level in more than twenty years. Average multifamily rental rates increased by record setting margins, as well. Apartment profitability is expected to increase even further in 2022, although probably at a slower pace following the uncertainty observed in 2020 and 2021, as the economy often started up and slowed down quickly with each new strain of the Coronavirus pandemic. As the economy continues its stabilized recovery, apartment demand will continue to grow. Strong household formation will drive rental increases above the record 400,000 apartments expected to hit the market in 2022. Apartment availability among top-of-the-line Class A units began 2022 at one of the lowest rates in over twenty years. Rental demand for Class B and C units, will also strengthen in 2022 as increasing prices prompt some apartment renters to give up more expensive apartments. Raw material and labor shortages also raise risks of construction delays in the home buying market, keeping many would be buyers in apartment rentals. As such, all multifamily properties will perform well in 2022.Urban areas continue to recover even as suburban demand gets stronger. The Coronavirus pandemic and associated lockdowns caused a movement, or transition, of households from densely populated urban areas and large urban cities to more suburban and rural settings and secondary market locations. Vacancy rates in the densely populated business districts of the country’s large markets rose 230 basis points in 2020, versus a 10 basis point vacancy rate increase in smaller suburban submarkets in smaller cities. Apartment availability has continued to decrease in these secondary market locations even though the worst of the pandemic has passed. Not including immigration, an estimated 44 million people will enter their 30s over the next 10 years, a stage of life associated with the beginning of families, which is the main driver of apartment demand. Increasing household size causes renters to look for larger accommodations, which are more affordable in suburban and rural locations. While this demographic change will continue in 2022 and beyond, urban areas are also recovering quickly as offices in downtown areas continue to reopen. The 2020 shock to downtown markets changed course by the third quarter of 2021, with further improvement anticipated in 2022. The reopening of retail establishments such as bars, restaurants and entertainment venues, the continuing return to offices, and a new group of college graduates all point to strong demand for the downtown apartments in urban locations.

2022 National Apartment Outlook

Federal rental aid during the pandemic prevented dire eviction projections. Historically, the vacancy rate in Class C apartments has tracked well with the unemployment rate. During the Coronavirus pandemic, however, when unemployment hit 14.8 percent, Class C vacancy stayed below 4 percent. Federal stimulus and eviction moratoriums kept many renters in their apartments even through layoffs, furloughs, and job losses. While eviction moratoriums have ended, over $40 billion in rental aid is being distributed which is helping to prevent large migration out of apartment units.Housing demand in 2022 is expanding into alternative dwellings. Households are being created faster than new construction can accommodate, forcing some apartment renters to look at other choices. Millennials seeking larger space at lower costs are considering single-family home rentals while those who are priced out of Class C units are looking more at manufactured home communities and mobile home parks.

The ability to work from home offices and pet-friendly accommodations are gaining importance in 2022. Even though the pandemic situation is improving, work habits adopted during the pandemic will not be so easily reversed. The increase in workers who still work from home has caused some renters to look for greater apartment square footage as well as common spaces within the building in which to co-work with others. A large increase in pet ownership caused by lockdowns also now causes strong demand for pet-friendly properties.

The strong apartment market nationally is causing many investors to consider investing in apartments and is causing strong demand for apartment loans. Apartment loan rates remain low as we enter 2022, but the Federal Reserve has indicated their desire to raise rates in 2022 to curtail inflation. We are watching closely to see what happens with apartment loan rates this year.

Resource Center

States We Provide Apartment Building Financing

Select Commercial Funding offers apartment building financing with premium rates and terms on multifamily financing throughout the United States. We strive to understand the ins and outs of each individual market in the country and to obtain the best financing for our clients no matter where the property is located. Our singular goal is to help you get the best possible multifamily financing in any state throughout the US. Please click the links below to check out our loan programs in each state and do not hesitate to reach out with any inquiries!